Black Mountain Gold USA Corp. (OTCQB: BMGCF) (TSXV: BMG) has entered the new year with a real excitement in the air about the journey ahead in 2022. And why not—the gold mining and exploration company has proven leadership, plenty of cash on hand, and a prospect-rich property nestled among other mines already producing in the Walker Lane Gold Trend in Mohave County, Arizona. Black Mountain Gold or BMG may be in the gold mining industry, but it’s a hidden gem flying well under the radar in the financial markets. In both the U.S. and Canadian markets, BMG is priced around $0.30 and offers a real opportunity for early investors.

A great starting point is with the company’s results-driven leadership and Board of Directors. After their overwhelming success in the development of Millennial Lithium Corp. (OTCQX: MLNLF) (TSXV: ML) into a desirable, advanced-stage lithium company, which culminated in Millennial being acquired for more than $400 million and its early investors realizing +1,300% returns, two key members of the company’s Board of Directors have transitioned from lithium to gold to create BMG. Graham Harris and Farhad Abasov—two names very familiar to Millennial investors—will now bring their expertise to the ever promising and highly lucrative gold mining industry.

Leadership in any company is the key to its success or failure. And BMG’s Chief Executive Officer (CEO) and Director, Graham Harris, together with BMG Board member, Farhad Abasov, have a resume of success that includes a penchant for developing smaller companies into advanced-stage companies that draw plenty of attention from much bigger players in the industry, and then negotiating attractive exit strategies. Harris and Abasov are joined at BMG by two additional Millennial executives.

Dr. Peter J. MacLean, Ph.D., P.Geo., who is currently the Senior Vice President-Technical Services at Millennial, has joined BMG’s Board of Directors and brings to the company over 25 years of exploration and development experience in North America, South America, and Africa. Meanwhile, Max Missiouk, CPA, CMA, who served as CFO for Millennial is now in the same role at BMG.

BMG’s executives have long careers steeped in success at raising capital—and plenty of it—so the company spent some of 2021 doing just that in preparation for the company’s 2022 drilling program. Executives expected to raise around $4 million, but after driving strong investor interest, BMG closed on a $5 million-private placement at $0.40/share. And it’s likely that the company is just getting started.

Obviously, it’s expensive to operate a mining and exploration company, so this seasoned group of executives should instill confidence in shareholders that they’ll ensure the company remains fully funded. Graham Harris has over 40 years of experience in the finance industry where he has directly raised over $400 million in development and venture capital for both public and private companies. Farhad Abasov has 18 years of experience in founding and managing natural resource companies and a proven track record of raising funds. He is directly responsible for raising over $500 million for public and private companies in both the energy and mining sectors. And Luke Norman, who joins this talented group of directors with 20 years of expertise in mineral exploration, finance, corporate governance, M&A, and corporate leadership, has himself raised more than $300 million for both public and private companies predominantly in the resources sector.

After discussing the leadership behind the company, and the company’s ability to stay fully funded, let’s dig into the property that is the real hidden “gold mine” behind the story of BMG. The company’s Mohave Gold Project is a mining operation years ahead of most junior mining companies. The reason is, tens of millions of dollars and several decades of exploration have already been dedicated to the property before operations were halted after the owner fell ill and later died. Thirteen years passed while the property was in probate, and today, BMG is taking full advantage of the money spent on development and equipment, infrastructure for production already on-site, and lots of hard work and historical data to draw from on the 3,200 acres that make up the Mohave Gold Project.

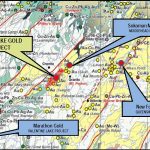

BMG’s Gold Project is ideally situated in mining-friendly Arizona in the well-known Walker Lane Gold Trend with several other producers, which stretches from BMG’s property at the southern end to near the Nevada-California state line in the Sierra Nevada Mountains to the northwest. The property has 160 claims, including lode and mill site claims, and numerous gold prospects on the property over a 10 km2 area.

The company’s property has a host of advantages that should allow BMG to far surpass the mining “startup” label given to new companies in the industry including:

(i) Its location in Arizona, which is a strong mining jurisdiction with plenty of skilled workers.

(ii) Lower costs for operating its Mohave Gold Project given previous development activity outlined gold mineralization potentially amenable to open-pit mining and heap leaching, which typically offer lower costs for major long-term expenses (CAPEX) and lower costs for day-to- day expenses (OPEX).

(iii) Fast-tracking development at the Mohave Gold Project because many key infrastructure assets are already in place after prior owners invested approximately $12 million in equipment preparing for mining, including 2 water wells, a leach pad, unlined ponds, a 350 tonne per hour crushing circuit with conveyor line.

(iv) Extremely strong upside with historical data and continued work like channel sampling done by BMG in 2021, which confirmed widespread gold mineralization, including 53.8 g/t Au over 2.8m and 0.7 g/t Au over 24.8m; promising historic drill results up to 3.76 g/t Au over 18.3m (Huffington Technical Report, 2020). And a recent Induced Polarization (IP) survey indicated potential expansion of mineralization at depth and new buried anomalies that warrant further investigation and testing through the company’s 2022 drilling program.

On the Mohave Gold Project, there are many historic mining prospects that remain to be drilled—almost no drilling at all was completed on the southern half of the property by prior owners despite the documented extensive gold-in-soil anomalies. Additionally, rock chip sampling has identified numerous styles of gold mineralization on the property, and air track drilling mostly on the northern half of the property, which included about 550 holes, totaling approximately 68,000 feet but limited to only 100 feet (34m) in depth to define material for a planned heap leach operation.

For shareholders, the company’s selection of this property came with a promising history. Previous exploration had been limited to surface and near surface exploration only. Detailed historical assays point to extensive gold mineralization at or near the surface, but BMG also plans to dig much deeper instead of settling solely for the gold at the surface.

If past is prologue, then BMG’s investors are in for quite a journey. It’s a trip that could resemble the path Millennial Lithium’s shareholders wandered down that recently landed them squarely in the middle of an attractive buyout deal with the NYSE’s Lithium Americas Corp. that was just completed late last month.

To learn more about Black Mountain Gold, visit https://blackmountaingoldusa.com or call toll free (833) 434-GOLD (4653).

About Black Mountain Gold USA Corp.

Black Mountain Gold is a junior mining company with a prospect-rich property in Mohave County, Arizona, located in the well-known Walker Lane Gold Trend. The company’s Mohave Gold Project has been explored for decades with millions of dollars poured into production infrastructure and development, and Black Mountain Gold’s seasoned Board of Directors and executives will now take full advantage of the property’s well-documented historical data on its 3,200 acres, 160 claims, including lode and mill site claims.

Read our Disclaimer and Disclosure for this company at: https://stockmarketmediagroup.com/disclaimer/